Financial literacy is an important topic to cover with children both in and out of the classroom. Several state standards, like TEKs, have an entire strand dedicated to financial literacy, and one of the core parts of developing an understanding of the concept is building vocabulary around financial literacy.

If you’re looking for ways to build language and vocabulary around financial literacy, this is the post for you! Let’s break down some of the key terms AND share a free set of financial literacy vocabulary cards for your Math Word Wall.

Which Financial Literacy Vocabulary Words to Teach?

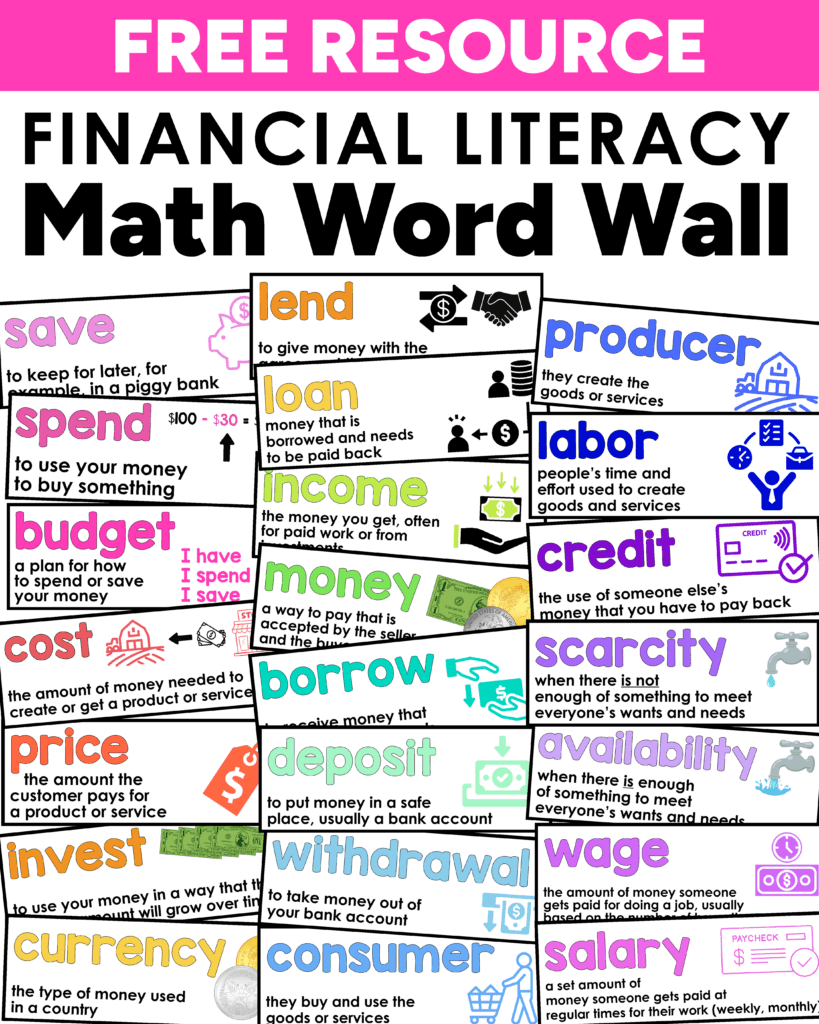

After reading through several sets of K-3 financial literacy standards, I pulled out 20 of the most common vocabulary words. Now, not all of these words are necessarily words that students need to memorize. However, building webs of knowledge includes exposing students to information that they can connect and come back to.

With that said, let’s look at 20 key financial literacy vocabulary words that we want to expose our students to as we build their understanding of financial literacy in K-3.

Key Financial Literacy Vocabulary for Students

Here is a list of 20 financial literacy vocabulary words for students in alphabetical order (not necessarily the order in which to teach them).

- borrow

- budget

- consumer

- cost

- credit

- currency

- deposit

- income

- invest

- labor

- lend

- loan

- money

- price

- producer

- salary

- save

- spend

- wage

- withdrawal

Bonus Words:

- availability

- scarcity

Which Vocabulary Words Should I Teach First?

Kindergarten Financial Literacy Vocabulary

In kindergarten, students are typically learning to: identify ways to earn income, differentiate between income and gifts, understand various jobs and their required skills, and to distinguish between wants and needs.

Their biggest focus will be on words such as income, money, labor, and price. Now, it’s important to note that students may not need to know the word “labor,” but they will be introduced to the concept of working and being paid for that work. Building this background will give students a solid idea to latch onto when they are asked to recall and use the actual term.

First Grade Financial Literacy Vocabulary

In first grade, students are beginning to connect the idea of earned income to how we provide for ourselves. This is supported by their work in kindergarten with distinguishing between wants and needs. Our income supports our needs first, and then our wants (hopefully!).

We can also introduce the relationship between spending and saving in first grade. The ability to distinguish the two, and understand that the less you spend, the more you save is an important benchmark for students.

With these considerations, students can be exposed to new financial literacy vocabulary, such as spend and save, while reinforcing previous words like income.

Second Grade Financial Literacy Vocabulary

In second grade, financial literacy can dive into financial relationships between:

- saving and budgeting

- borrowing and lending

- producing and consuming

- depositing and withdrawing

We want students to understand that if you can save little amounts at a time, they can grow into larger amounts over time. We want them to see saving as an alternative to spending, and how to make responsible decisions, especially as it comes to overspending and borrowing.

Finally, we want to begin introducing students to the relationship between producers and consumers, and how cost and labor can play a part in the price of a simple item.

Therefore, we want to ensure we’re exposing students to the following new words, stressing their connections when possible: budget, borrow, loan, lend, producer, consumer, and cost.

Third Grade Financial Literacy Vocabulary

In third grade we get to start exploring some pretty mature concepts like the connection between human labor and income, the benefits of savings plans, how credit works, common financial transactions, and decisions that need to be made around finances. Under some standards, we even get to dive into the relationship between the availability and scarcity of resources and how this can impact cost.

We can also begin to understand the concept of money as a form of payment that is accepted by both the buyer and seller, and currencies are the type of money that can vary from country to country.

Some new, key financial literacy vocabulary that comes up around these topics include: deposit, withdrawal, salary, wage, currency, credit and invest. You can also add in bonus vocabulary like scarcity and availability if the concept of demand is included in your curriculum or standards.

Connections between Financial Literacy Vocabulary Words

Many of the financial literacy words are connected, and it’s important that as we teach these words, we stress the connection to other words. For example, the terms deposit and withdrawal are connected as opposing actions. One puts money into your account, and one removes money from your account. Teaching these words together will help build the connection between them.

Some important pairs and groups to build connections between include (not an exhaustive list):

- spend, save

- consumer, producer

- salary, wage, income, labor

- money, currency

- lend, loan, borrow, credit

- labor, cost

- budget, save

- price, cost, scarcity, availability

- invest, budget, save, deposit

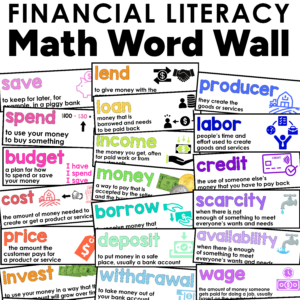

Free Financial Literacy Vocabulary Cards for K-3

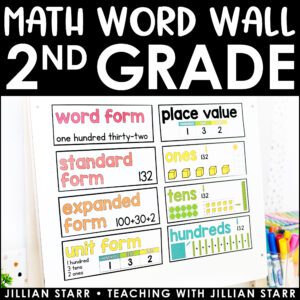

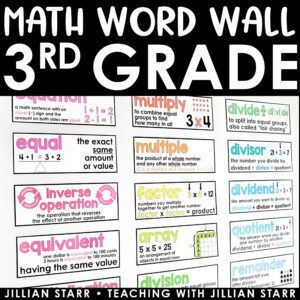

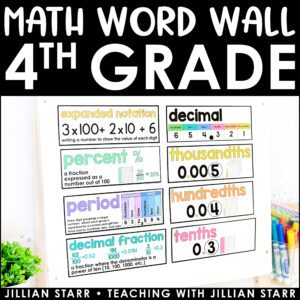

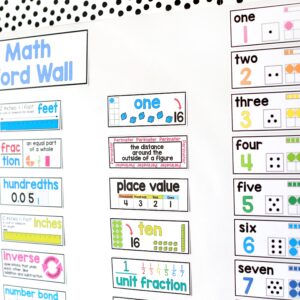

My math word wall was always a focal point of my classroom because it was such a great visual reference tool. I want to make sure that you have the same tools when it comes to financial literacy vocabulary, too!

That’s why I created 22 FREE Financial Literacy Vocabulary Cards to add to your math word wall and to enhance your financial literacy unit! Grab them below!

Free Financial Literacy Word Wall

20+ FREE vocabulary cards to boost your financial literacy lesson!

I hope this post and the free resource have been helpful! If you have questions, feel free to pop them in the comments below, and I’ll be happy to answer them.

Looking for even more ideas for teaching financial literacy? Check out this post about 3 Engaging Ways to Bring Financial Literacy into Your Math Class.

Leave a Comment