Financial literacy for kids has become a hot topic in education. Districts and states nationwide have standards aiming to build economic concepts and financial literacy skills. Teachers are even designing their own classroom economy systems!

But how do you fit these key skills into an already crowded school day?

The good news: economics and financial literacy aren’t stand-alone topics. That means they can be embedded into the units you’re ALREADY teaching.

Your math class is the perfect place to build foundational financial literacy skills without adding yet another unit to your packed schedule.

Here are three ways to start incorporating financial literacy concepts into your math class!

Understanding Value

The first component of financial literacy is understanding value. What is something (a good or a service) worth?

This isn’t as simple as it sounds. While children often start to develop a sense of value and worth early on, monetary value is quite complex and abstract.

Instead, try this:

Start with Bartering.

Most successful financial literacy units for kids begin with bartering. And that’s a great place to start!

For example: You can ask, “What would you trade for this ice cream cone?” and students will have to think about one good or service they could trade for the ice cream cone. They must think about: How much do I want or need this good? How rare is it? What do I currently have that is equal to the value of that ice cream cone? (Hey! Math language already!)

Teach Value Indirectly.

You might be thinking, what does that mean?

Think of value as another form of measurement. We often begin to teach measurement using nonconventional units, such as unifix cubes or hands and feet.

Like measurement length, you can teach units of VALUE indirectly. How? With unconventional or student-created value systems. These build a foundational knowledge that will translate into currency later on.

First, I like to begin by picking an object to trade and a math manipulative as currency. For example, I might put a picture of a scoop of ice cream on the board and ask, “How many unifix cubes would you give for this ice cream?”

Yes, you might get some wild answers at first or even some blank stares. After all, you don’t typically trade unifix cubes for ice cream cones.

Next, I write down student answers and present a new object, such as a teddy bear. This time, I ask, “If you would trade X number of unifix cubes for the ice cream cone, how many would you trade for this teddy bear?” This gets students to think: If one item costs X amount, the next item will cost more or less depending on its value.

After a few rounds of this activity, students begin to notice the pattern. Objects that have a higher value are worth more unifix cubes.

Note: While it is fun to design your own forms of currency eventually, that can be quite overwhelming. Later, you can create a classroom currency to build a more in-depth understanding of currency systems.

Teaching Coin Values

As I mentioned, money is quite abstract. However, understanding the value of our actual money systems is not just a standard we need to check off. It is a real-world skill that students need to grasp.

Coin Identification

I will never forget an email I received from a concerned parent. His daughter didn’t know the value of a dime. Even more concerning to him, she didn’t know what a dime looked like. Why? She only saw her parents use credit cards. She had no experience using or sorting through coins.

It was a great reminder that many of our students will come with limited background knowledge around coins and money, given how little some people interact with physical representations of currency. In short: don’t skimp on your money unit.

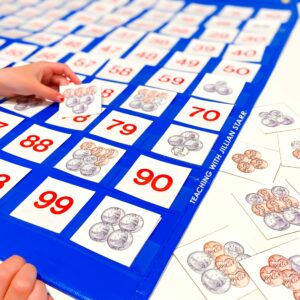

So how do we build knowledge of money for students? First and foremost, students need to be able to identify different coins. Enter: Coin sorting.

Sorting coins can be a great way for students to familiarize themselves with coins. The simple act of sorting coins on a coin sorting mat can really help students.

Coin Values

Knowledge of coins doesn’t stop at identification. Just because students know how to identify a coin doesn’t mean they understand the value of it.

Visual representation is crucial for teaching coins and their unique values. I have found that connecting cubes are the best math manipulative for the job. I connect the cent value to a picture of the coin. For example, a quarter would be 2 sticks of ten plus a stick of five snapped together. (The blocks seen below are called Omnifix Cubes, and connect on all sides.)

I love this because students can visualize individual cent values as well as how different coins add together. For example, how a quarter and a nickel together make thirty because the nickel completes the stick of ten.

Once students understood the value of each coin, they were ready for coin-counting activities!

Money Math

No post about financial literacy or money math would be complete without word problems.

Word problems present real-world financial challenges. Once students understand the values of our coins and dollars, they can start thinking about how to add, subtract, multiply and divide them.

Two types of word problems particularly benefit students as they build financial literacy skills.

Single-answer word problems are an excellent way to practice identifying operations and practice with number-specific situations.

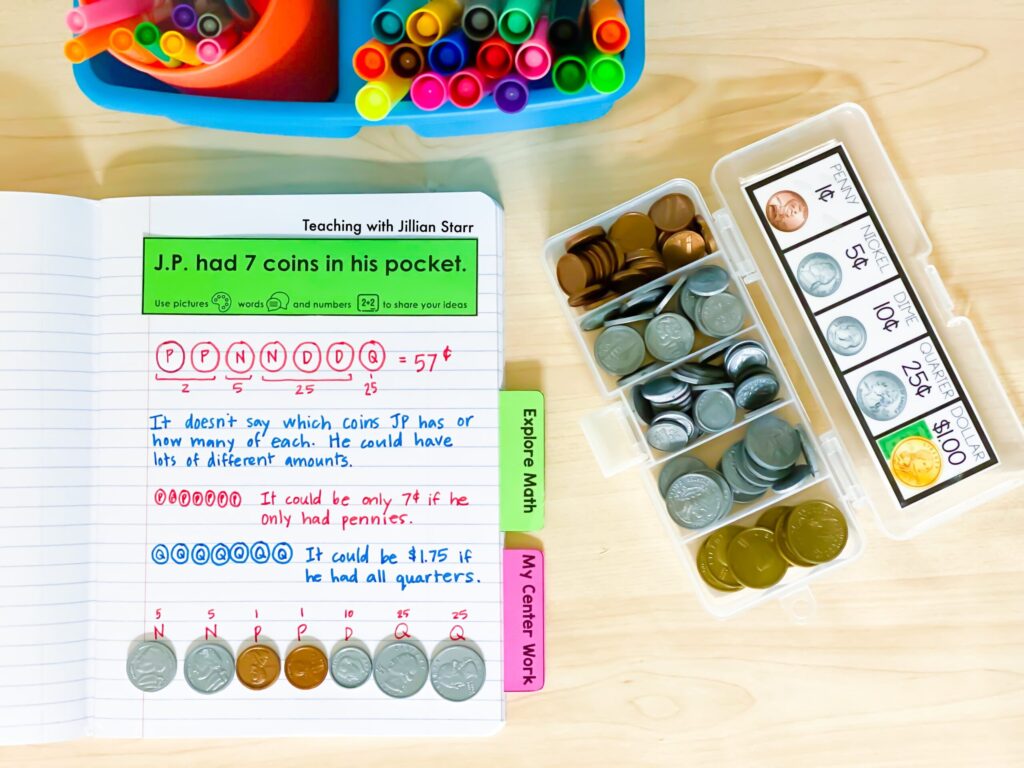

However, my personal favorite is Open-ended math prompts. They allow for endless problem-solving and require students to think creatively and logically about coin and dollar values. I particularly love these word problems because they challenge students to build their own meaning around money.

These types of math journal prompts became a staple in my math classes. I found that my students would spend hours coming up with new combinations with coins, if allowed!

Financial literacy isn’t just a trend in education. It is a skill that can transform your classroom into a place of equity. You may have a designated financial literacy unit or simply know that it is a skill that will empower your students. No matter what, remember: your math block builds the foundation for financial literacy. How have you started to incorporate more financial literacy into your school day?

Leave a Comment